- Patrick Roney

- (877) 503-8607

Follow Us :

Follow Us :

Proledge

February 1, 2024

The long-term success and profitability of your organization will be influenced by many factors, ranging from trends in the industry you operate to the quality and originality of the products or services you offer. However, a less discussed aspect that can have a massive effect on your long-term outlook is the accuracy of financial data. We at Proledge cannot change the elements of your business that require the expert knowledge of your staff, but we can reduce their workload, ensure that your financial data is secure, and that your books are ready in case of an inspection by the IRS.

Our employees have the necessary experience to tackle your requirements in a new light, and we can create a long-term plan to centralize your data and import it to the cloud. What is the main advantage of contacting a bookkeeping service company like us? The expertise and accuracy of the support we offer. With the help of our offerings, you can be sure that your financial records will be in compliance with the regulations active in your industry and correspond with the information your collaborators have access to. Our bookkeeping offerings are suitable for small and medium-sized businesses and are scalable according to your company’s growth objectives.

Are you a company operating in Texas? Then, you are competing against hundreds of thousands of other employers, many of whom are in the same business as you. The goal of a company specializing in quality bookkeeping service, as we are at Proledge, is to streamline the internal processes used by your firm and record your financial data accurately and cost-efficiently. Our bookkeeping offerings are ideal for allowing your staff to focus on the core objectives of your enterprise, which will ultimately lead to progressive but predictable growth in profitability.

Our remote services are scalable according to your company’s preferences, we are adequately insured so you can rest knowing that your business is in safe hands, we have access to the latest bookkeeping tools on the market, and we specialize in QuickBooks. Moreover, we can offer deep insights into your financial data, present quarterly, monthly, or weekly reports about your transactions, and offer training and professional support to employees. Why use the professional bookkeeping offerings provided by a company like ours? Easy of mind, which in the business world is a pillar for long-term success.

The services offered by our firm are also cheaper than setting up an in-house accounting department, and this is due to our unique bookkeeping approach. When you call our firm, the requirements of your business will be assisted by two bookkeepers, one junior and one senior. The services of the senior bookkeeper will be reserved for complex operations that require professional expertise. In contrast, the data collection operations, common in ledger management, will be performed by the junior bookkeeper. What does this mean for you? Lower costs and increased security.

You can contact us anytime if you have questions or encounter a problem with your bookkeeping program.

Do you want to use the offerings of a professional bookkeeping company based in the great state of Texas? Then we are the right people for your requirements. How can we help your business? For one thing, we can take care of your data entries and make sure that your invoices and receipts are properly cataloged and stored in a secured online or offline medium. Secondly, we can make sure that your financial data corresponds with your bank’s statements, and if there are discrepancies, we can correct them and alter our internal systems to coordinate with your long-term requirements.

Our specialists will take care of your APs and ARs, calculate and process salaries, bonuses, and tax deductions, collaborate with your CPA, and prepare the necessary documentation for tax filings. Moreover, we will keep track of your expenses, create regular forecasts for your internal budget, and migrate your financial data to the cloud. From financial consulting to the management of financial balances, using a professional bookkeeping service company like ours is an excellent idea and will be the best way for your staff to receive the required training for long-term financial success.

64% of business owners personally manage their bookkeeping, which at first glance might seem like an intelligent measure to save significant sums. However, counter-intuitively, this could be a financially damaging way of doing business. The problem with in-house bookkeeping offerings is that you are solely responsible if you catch the attention of the American tax authorities. Working with our firm, for example, comes with guarantees, as our services are insured, which can make you confident that in case of an error, you will not be the one to suffer.

Things get even more complicated when your business is on an upward trend. Are you a firm based in Dallas, and is your venture starting to gain traction? In that case, you should probably start looking for a bookkeeper. Doing your bookkeeping in-house will ultimately result in a significant decrease in your staff’s productivity, as they will now have to juggle financial recording tasks with their everyday domain-specific workflow. The services of external firms like ours are secure, come bundled with access to high-quality software, and can be a measure by which to discover problems in the in-house systems you use.

Do you think you might be the target of fraudulent practices? In that case, our company will work with your CPA and do a thorough analysis of your records. Do you want to improve the consistency of your financial statements? If so, the experience of our employees will be essential for your company. Using a professional bookkeeping service firm such as ours guarantees that you will be aware of state tax laws, that you will comply with the regulations imposed on your industry, and that you will take the best measures available to make your financial transactions efficient.

Ultimately, using the professional services of a bookkeeping service company is a personal decision. But we are confident that our offers can be a net positive for your business. By outsourcing your bookkeeping-related tasks to a third party, you will improve the performance of your staff, reduce the risk of your company coming to the attention of the IRS, discover ways to gain tax exemptions, and find irregularities that can negatively impact your finances.

For businesses operating on a national or international level, outsourcing bookkeeping offerings has become a common occurrence, essential for focusing on the business elements that influence market share. Are high-quality bookkeeping offerings free? No, but their ROI is significant. Plus, the amounts you can save by outsourcing your financial tasks to professionals can make the difference between a business that will close in a few months and one that will become a market authority in a couple of years.

Fill out the form below to sign up to our Blog Newsletter and we’ll drop you a line when new articles come up.

Today our MVP spotlight shines on Melissa Fletcher, a ProLedge Account Manager and accounting veteran with over 25 years combined experience in public accounting, as well as, an industry

The long-term success of your company will be influenced by the competitiveness in your field of activity, the tools used by your staff, and the reputation your business has built

Keeping good financial records is a common nightmare for most small business. What should you keep? How long? Is electronic OK? How to organize all these documents? Here are some

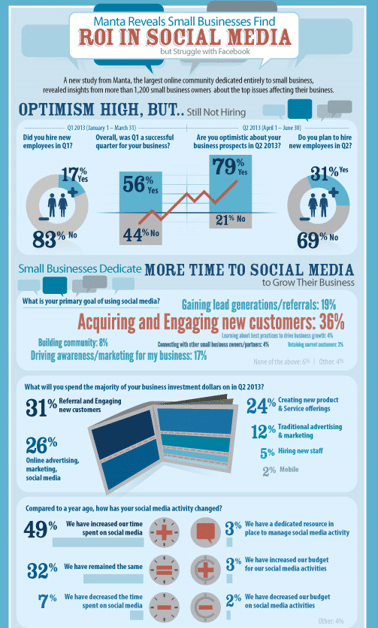

According to a recent small business study conducted by Manta, more than half of the 1,200 small business owners surveyed boasted of a fruitful Q1 and 79% are optimistic about

Profitability and success in the business world go hand in hand with the quality of the services you offer and the professionalism of your staff. However, another aspect that is

Intuit, the maker of QuickBooks, releases new versions of QuickBooks on a regular basis. Some are called “Updates” and those are free. Some are called “Upgrades” and those need to

Bookkeepers.

Professional. Affordable.

ProLedge is a bookkeeping services firm.

Copyright © 2024 All rights reserved.

Hello. Can we help you?